XRP Price Prediction: Will XRP Hit $3 Amid Technical Pressure and Institutional Growth?

#XRP

- Technical Resistance Levels: XRP faces immediate resistance at the 20-day MA ($2.4498) and upper Bollinger Band ($2.7013), with current price action below these key levels

- Institutional Growth Catalysts: Ripple's expansion through acquisitions and RLUSD's $1B+ market cap provide fundamental support for long-term price appreciation

- Regulatory and Market Developments: Potential XRP ETF approval and increased corporate adoption could drive significant price movement toward the $3 target

XRP Price Prediction

XRP Technical Analysis: Bearish Signals Dominate Short-Term Outlook

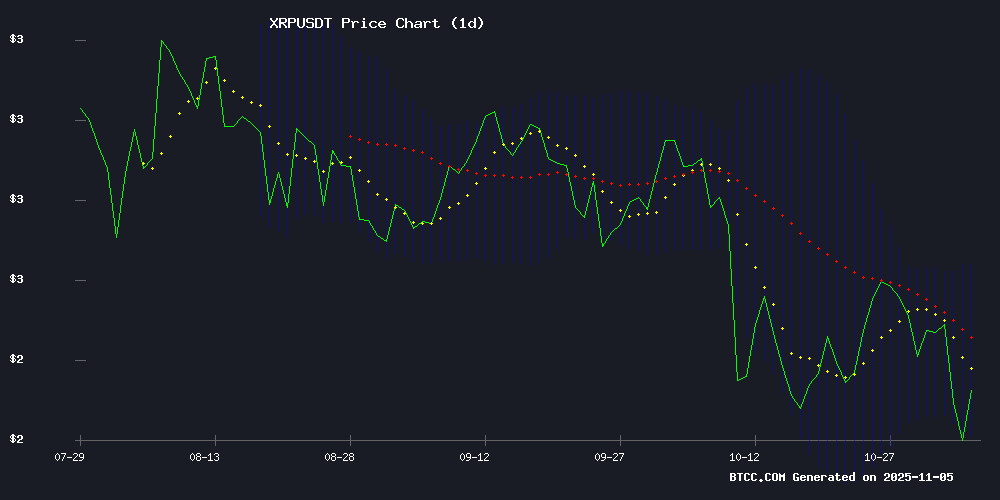

According to BTCC financial analyst Sophia, XRP's current technical indicators present a mixed but predominantly bearish short-term picture. The price of $2.2404 sits below the 20-day moving average of $2.4498, indicating potential resistance ahead. The MACD reading of -0.0341 shows negative momentum, though the narrowing gap between the MACD and signal line suggests weakening bearish pressure. XRP is trading NEAR the lower Bollinger Band of $2.1984, which could act as immediate support. Sophia notes that a sustained break below this level might trigger further declines toward $2.00.

XRP Market Sentiment: Long-Term Optimism Battles Short-Term Concerns

BTCC financial analyst Sophia observes that recent XRP developments create a complex sentiment landscape. While institutional adoption continues with Ripple's acquisition of Palisade and SBI Holdings' $200M investment in Evernorth, short-term price action remains constrained. The stabilization at $2.43 following a 42% flash crash recovery demonstrates underlying strength, but current prices below this level suggest ongoing pressure. Sophia highlights that the potential for an XRP ETF and China's DeepSeek AI predicting $10 by end-2025 provide long-term bullish catalysts, though these may not immediately overcome current technical weakness.

Factors Influencing XRP's Price

XRP Under Pressure: Can Bulls Hold the Line Above $2?

XRP faces mounting bearish pressure as it struggles to sustain momentum above the critical $2 threshold. The token's volatility has intensified, with analysts closely monitoring whether bullish support can avert further declines. Currently trading at $2.31, XRP reflects a 1.73% downturn.

Market dynamics reveal heightened selling pressure, mirroring broader altcoin outflows. Despite this, XRP maintains its position among the top five cryptocurrencies by market capitalization, which stands at approximately $139 billion. Trading volumes continue to rise, hinting at potential short-term bullish momentum.

Technical indicators suggest recent overbought conditions led to consolidation. Resistance looms at $2.3024, with a breakout potentially propelling prices toward $2.3500.

Ripple's Evolution from XRP Issuer to Financial Infrastructure Powerhouse

Ripple has transformed from a blockchain company embroiled in legal battles to a formidable financial infrastructure provider. The firm now operates a full-stack institutional platform resembling a modern investment bank, leveraging XRP and its regulated stablecoin RLUSD.

With the launch of Ripple Prime and the integration of its payments and custody solutions, Ripple has built an ecosystem where transactions, settlements, and custody layers run on its proprietary rails. This vertical integration positions Ripple at the center of global digital money movement.

The company's 2025 acquisition spree—including prime broker Hidden Road and custody firm Palisade—laid the groundwork for this expansion. Legal clarity from its SEC case allowed Ripple to aggressively pivot toward regulated financial services.

XRP Price Prediction: Short-Term Bearish Signals Clash with Long-Term ETF Optimism

XRP faces technical headwinds as a death cross emerges on its 10-day and 20-day EMAs at $2.70, signaling potential near-term downside. Analyst @ChartNerdTA notes these patterns often mark peak selling pressure, with $2.00 looming as critical support.

Grayscale's XRP spot ETF filing injects bullish momentum into the narrative, suggesting institutional interest may outweigh technical weakness. "Death crosses are lagging indicators," observes @ChartNerdTA, hinting the worst may be priced in.

A hidden bullish divergence on monthly charts offers contrarians hope. @jaydee_757 highlights XRP's macro structure remains intact, with past corrections frequently preceding renewed rallies.

Ripple USD (RLUSD) Surpasses $1B Market Cap, Cementing XRPL's Stablecoin Leadership

Ripple's USD-pegged stablecoin RLUSD has eclipsed $1 billion in market capitalization just five months after its December 2024 launch, becoming the dominant stablecoin on the XRP Ledger. The milestone signals growing institutional confidence in Ripple's settlement infrastructure as the token gains real-world utility across both XRPL and Ethereum networks.

"The RLUSD team puts the pedal to the metal every day," said Ripple President Monica Long, praising Senior VP Jack McDonald's stablecoin division. The 1.02 billion circulating supply milestone comes as Ripple Prime accelerates cross-border settlement capabilities, with executives positioning RLUSD as the compliant bridge between traditional finance and crypto markets.

Nate Geraci Predicts XRP ETF Launch Before Mid-September

Nate Geraci, a prominent ETF analyst, forecasts the arrival of a spot XRP ETF by mid-September, reigniting speculation in the crypto market. This prediction follows years of regulatory uncertainty for Ripple, which recently settled its legal battle with the SEC.

Retail investors have accumulated $1.39 billion in XRP since early September, signaling strong demand. Major firms like Grayscale, Bitwise, and CoinShares are also preparing XRP-based ETFs, suggesting institutional confidence in the asset.

The SEC's apparent shift in stance marks a significant turning point for XRP, transforming it from a marginalized token to a potential market leader. The anticipated ETF launch could provide the validation XRP needs to solidify its position in the digital asset ecosystem.

Ripple Acquires Palisade to Expand Crypto Services and Support Corporate Adoption

Ripple has acquired Palisade, a leading crypto wallet and custody provider, in a move that significantly bolsters its institutional offerings. The integration of Palisade's wallet-as-a-service platform into Ripple Custody will enhance secure storage solutions for fintechs, crypto-native firms, and traditional financial institutions.

The acquisition underscores Ripple's aggressive $4 billion expansion strategy in institutional crypto services. By combining Palisade's technology with Ripple Payments, the company aims to streamline crypto-to-fiat conversions and foster DeFi collaboration opportunities.

"Businesses increasingly demand licensed, trustworthy partners for their crypto operations," said Ripple President Monica Long. The deal positions Ripple as a key infrastructure provider amid growing corporate adoption of digital assets.

SBI Holdings Leads $200M Investment in Evernorth to Boost XRP Adoption

Japanese financial giant SBI Holdings has committed $200 million to Evernorth, a new institutional vehicle designed to expand XRP's role in global finance. The investment, confirmed by SBI CEO Yoshitaka Kitao, marks a significant push for XRP adoption in collaboration with Ripple.

Evernorth aims to raise over $1 billion, with SBI's initial $200 million earmarked for purchasing XRP from the open market. The goal is to build one of the world's largest public XRP treasuries while actively deploying the asset in institutional lending, DeFi, and liquidity operations.

The move signals a shift from passive holding to active utilization, potentially integrating XRP deeper into financial infrastructure. SBI's investment builds on its longstanding partnership with Ripple through SBI Ripple Asia, which drives XRP adoption across Japan and beyond.

Ripple USD (RLUSD) Reaches $900 Million as Brale Brings Regulated Stablecoins to XRP Ledger

Brale has launched regulated stablecoin support directly on the XRP Ledger (XRPL), enabling fintechs to issue and manage USD-backed stablecoins like Ripple USD (RLUSD) within a compliant system. RLUSD has reached nearly $900 million in circulation since its late 2024 debut.

The integration marks a pivotal step in bridging traditional finance with blockchain, offering businesses programmable digital dollars on one of crypto's most established payment networks. XRPL's low-cost, high-speed settlement infrastructure now supports Brale's API for creating, managing, and settling fiat-backed stablecoins.

"We're thrilled to bring compliant, programmable money to one of crypto's most proven networks," Brale stated, highlighting the solution's on-ramp, off-ramp, and wallet infrastructure for institutional users.

China’s DeepSeek AI Predicts XRP Price Could Hit $10 by the End of 2025

China's DeepSeek AI has projected a bullish outlook for XRP, forecasting a potential surge to $10 by the end of 2025. This prediction coincides with significant regulatory and institutional developments in the U.S. digital asset landscape.

The Federal Reserve is exploring direct access for fintech and crypto firms to its payment systems, a move that could revolutionize blockchain-based payments. Ripple, the company behind XRP, has already applied for a Federal Reserve master account, aiming to bridge blockchain technology with traditional finance.

Approval would enable Ripple to facilitate faster settlements, integrate with FedNow, and expand services like digital custody and tokenized assets. The Federal Reserve is also actively studying AI, tokenization, and smart contracts to modernize its infrastructure.

Ripple's potential access to Federal Reserve payment rails could provide a strategic advantage in the stablecoin and cross-border payment markets. XRP's design as a fast, low-cost settlement token positions it as a key player for institutional adoption, especially with Ripple's pending U.S. banking license and alignment with ISO 20022 standards.

Ripple’s $1 Billion Move and National Bank Ambition Draw Mixed Reactions

Ripple's acquisition of GTreasury for $1 billion marks a strategic push into traditional finance, leveraging blockchain to enhance banking systems. The deal, serving 1,000 clients across 160 countries, aligns with growing institutional demand for digital asset infrastructure.

Criticism from SWIFT's CIO Tom Zschach, citing Ripple's alleged lack of client trust and regulatory capital, was swiftly countered by crypto lawyer Bill Morgan. Morgan highlighted Ripple's U.S. national bank charter application as evidence of its regulatory progress, framing the GTreasury integration as a mirror of banks' own digital asset adoption.

The clash underscores the tension between legacy financial players and crypto-native firms vying for dominance in the evolving payments landscape.

XRP Stabilizes at $2.43 After 42% Flash Crash Recovery

XRP holds steady at $2.43, marking a 1.1% decline over 24 hours as traders assess the aftermath of last week's violent 42% flash crash. The October 11 plunge to $1.64 triggered a 164% surge in trading volumes before partial recovery, with bulls now defending the $2.40 support level.

Technical damage from cascading liquidations lingers, with October 17's 5.82% drop signaling potential retests of $2.00 support. The absence of fundamental catalysts leaves chart patterns driving price action, while XRP continues decoupling from Bitcoin's trajectory amid mixed crypto market performance.

Will XRP Price Hit 3?

Based on current technical indicators and market developments, reaching $3 in the immediate term appears challenging for XRP. The price currently trades at $2.2404, requiring approximately 34% upside to reach the $3 target. Technical resistance at the 20-day MA ($2.4498) and upper Bollinger Band ($2.7013) create significant hurdles. However, BTCC financial analyst Sophia notes that several catalysts could drive XRP toward $3 in the medium term:

| Factor | Impact | Timeline |

|---|---|---|

| Potential XRP ETF Approval | High Positive | Mid-2025 |

| RLUSD Stablecoin Growth | Medium Positive | Ongoing |

| Institutional Adoption | Medium Positive | 6-12 months |

| Technical Breakout Above $2.70 | High Positive | Short-term |

Sophia emphasizes that while current technicals suggest consolidation between $2.20-$2.70, successful breach of the upper Bollinger Band could accelerate momentum toward $3, particularly if coupled with positive ETF developments or increased institutional adoption.